In today’s digital age, the concept of payment methods has evolved significantly, introducing a wide array of options for consumers and businesses alike. Understanding the concept of payment methods is crucial in navigating the complex landscape of modern transactions.

What is a Payment Method?

Payment methods refer to the various channels and instruments through which monetary transactions are conducted. These methods facilitate the transfer of funds from the payer to the payee, enabling the exchange of goods and services. Popular types of payment methods include traditional options such as credit and debit cards, bank transfers, and digital wallets.

However, with the proliferation of online and mobile payments, security concerns have become increasingly prominent. Safeguarding sensitive payment information and ensuring secure transactions have become critical considerations for both consumers and businesses.

Why Accept Alternative Payment Methods?

Accepting alternative payment methods offers several advantages for businesses. These options provide greater convenience and flexibility for customers, leading to improved payment experiences and higher satisfaction levels. Moreover, embracing alternative payment methods can have a significant impact on global payments, catering to diverse consumer preferences worldwide.

Implementing alternative payment methods requires strategic planning and integration into existing payment systems. Businesses need to adapt to the evolving landscape of payment preferences and leverage these methods to enhance their overall payment strategies.

Popular Alternative Payment Methods

Exploring different types of alternative payments unveils a range of options, including digital wallets, mobile payments, prepaid cards, and online bank transfers. These alternative payment methods offer numerous benefits, such as enhanced security, simplified checkout processes, and seamless integration into e-commerce platforms.

Comparing popular payment methods reveals the diverse nature of alternative payments and the unique advantages they offer over traditional options. Businesses need to assess the suitability of these methods based on their target customer demographics and preferences.

How to Use Alternative Payment Methods?

Integrating alternative payments into business strategies requires a deep understanding of consumer behavior and payment preferences. Secure transactions with alternative payments mandate robust payment processing systems and adherence to stringent security measures to safeguard sensitive financial data.

Additionally, the rise of mobile wallets and their integration with alternative payment methods has revolutionized the way consumers make payments. Leveraging these technologies presents new opportunities for businesses to offer seamless and convenient payment experiences to their customers.

Global Payment Strategies

Adapting to local payment methods is crucial for businesses expanding into international markets. Embracing alternative payment methods versus traditional options necessitates an understanding of regional preferences and regulations, ensuring a frictionless payment experience for global customers.

New trends in alternative payments continue to shape the payment ecosystem, introducing innovative solutions and evolving consumer preferences. As businesses navigate the complex landscape of global payments, staying abreast of these trends is essential for maintaining a competitive edge in the market.

Different types of alternative payment method

There are eleven common types of local, digital and online alternative payment methods. Here’s a list:

Bank transfers

Bank-transfer apps take funds from the customer’s bank account and send them to the merchant’s. Usually, these are push payments. In their online or mobile banking app, the customer checks the amount and authorises the payment. Transfers may take several business days. But thanks to real-time interbank payment systems, funds are often transferred within seconds.

Buy Now Pay Later (BNPL)

Buy Now Pay Later payment methods let customers do exactly what the name suggests, buy something now but pay at a later date. Many allow customers to pay thirty days after the purchase date. Some also allow the customer to pay in instalments or even with post-dated payments. Some BNPL payment methods are online only, some can also be used in stores.

Card-based payment methods

The most well-known cards are Visa and Mastercard. But there are also lots of local card schemes, specific to a country or region. These alternative payment cards can be co-badged with international card brands for wider acceptance. Some prominent examples are RuPay in India and Troy in Turkey.

Card wallets

Card wallets are mobile apps that link to the customer’s store-payment card. A secure, tokenised card number is generated for each transaction. This is a secure and convenient way for customers to shop online, and sometimes in-app or in-store, without having to enter or reveal card details.

Carrier billing

With carrier billing, customers add the cost of purchases to their mobile phone bill. Customers must have a mobile phone account, but not necessarily a smartphone, as carrier billing solutions generally work via an SMS (text) or IVR interface.

Cash-based payment methods

Cash-payment methods let customers who don’t have either a credit card or a bank account shop online. At the online checkout, they select the cash-payment option. This generates a way of linking the online purchase to a cash payment, for instance a unique ID number or a printable bar code. The customer takes this to a participating store and pays. The store sends their payment to the online merchant, along with the unique identifier. The merchant then ships the customer’s order.

E-wallets

Like a real wallet, an e-wallet is a way to store money. Customers load cash onto their e-wallet using a bank-transfer, their credit card or even by paying cash at a participating store. They can then use their e-wallet to shop, either online or in store. Customers need internet access via a desktop, laptop or mobile device to use an e-wallet. Popular examples include Alipay, WeChat Pay, PayPal and Skrill.

Mobile wallets

Customers must have a mobile phone to use a mobile wallet — but not always a smartphone. This is the difference between a mobile wallet and an e-wallet. Customers load their mobile wallets by paying cash at a participating store, using carrier billing or with a bank transfer. They can then use them to pay online and perform other transactions. Some mobile wallets link directly to the customer’s bank account, others don’t need the customer to even have a bank account.

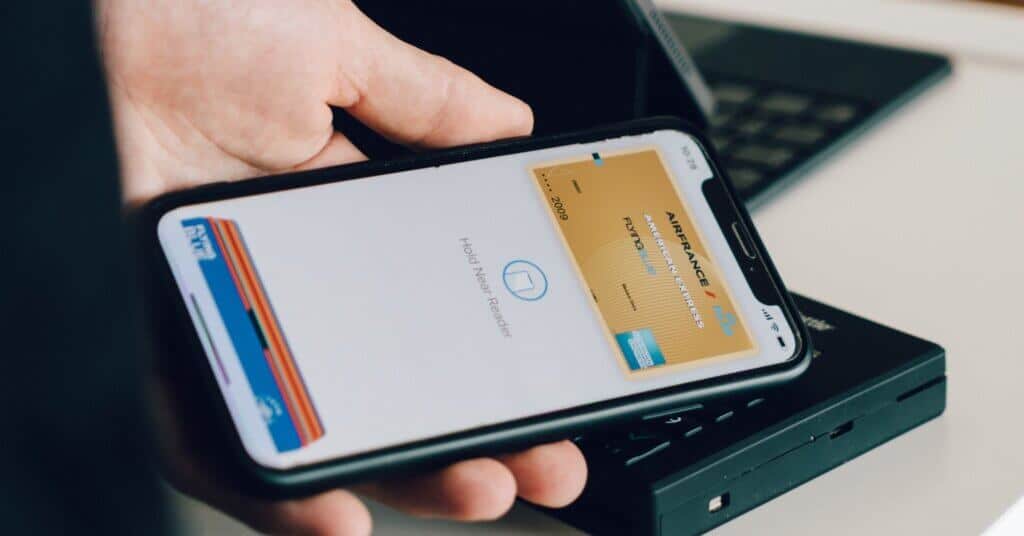

Pass-through wallet

A pass-through e-wallet is a type of digital wallet that does not hold a balance by itself but passes the transaction through to another payment instrument. Some examples of pass-through e-wallets are ApplePay or GooglePay. ApplePay simply passes the transaction to the customer’s credit card or bank account. Customers don’t load money onto ApplePay itself.

Prepaid vouchers

Customers can usually buy prepaid vouchers at participating stores or online. Each voucher is printed with a code, which the customer inputs at checkout to pay for their online purchase.

Virtual cards

Virtual cards allow customers to pay online without entering or revealing their bank or card details. The cards are usually single-use or available for a limited time only.

How to know which alternative payment methods to offer

Which payment method varies from country to country. Dutch consumers use the bank-transfer app iDEAL in almost 60% of transactions [1]. But in neighbouring Belgium all bank-transfer apps combined only have a 19% market share [2].

The type of alternative payment method preferred may also differ within markets. In the Philippines, most shoppers use digital payment method [3]. But 65% of Filipinos don’t have a bank account. For them, cash is king [3]. If you don’t support local cash-payment methods, they won’t shop with you.

PPRO is a fintech company that globalises payment platforms for businesses, so they can offer more choice at the checkout and boost cross-border sales. Based on your goals, we can help you work out which alternative payment methods to offer in any market.

Alternative payment method FAQ

What kind of business needs alternative payment methods?

Any business that hopes to succeed in any market, whether it’s selling cross-border or opening a local affiliate, must accept alternative payments.

Not offering a payment method which consumers know and trust can cause cart abandonment rates of up to 44% [4]. To reduce cart abandonment, merchants must offer the preferred alternative payment methods for each country

What are the merchant fees on alternative payment methods?

Merchant fees on alternative payment methods vary. But they are usually significantly lower than the fees charged by mainstream payment methods.

Are alternative payment methods secure?

Yes, if you integrate them well. There are too many alternative payment methods to generalise about topics such as security, risk or compliance. But PPRO can help you select payment methods for your target market based on both their relevance and things such as security and compliance. We can also help you to add extra layers of security, for instance to prevent chargeback fraud and improve fraud detection.

How do I integrate alternative payment methods?

You can integrate each alternative payment method yourself. This involves up a bespoke contract. You’ll then have to do integrate, test and validate the payment method yourself. That includes running compliance and legal checks — and so on. Or you can work with a payment specialist, such as PPRO.

At PPRO, we’ve built an infrastructure that lets you launch multiple payment methods at speed and avoid all the contractual and operational complexities along the way. You benefit from a single, straightforward integration. We provide ongoing support and remove the need to worry about legal or contractual details.

What is the difference between local, alternative, digital, online payment methods?

These categories often overlap with each other. But they are not exactly the same.

The meaning of ‘alternative payment method’ depends on the context. It can simply mean payment methods other than cards. But many people understand it specifically to mean cryptocurrencies such as Blockchain or Ethereum.

‘Local payment methods’ are any payment methods other than the global standard bearers (Visa, Mastercard etc) which are popular or dominant in any given market. For instance, in China, AliPay has a market share of over 50% for online payments [5], making it a locally preferred payment method.

A digital payment method, for instance an e-wallet, can be used both online and instore. Online payment methods, on the other hand, as the name suggests can only be used online.